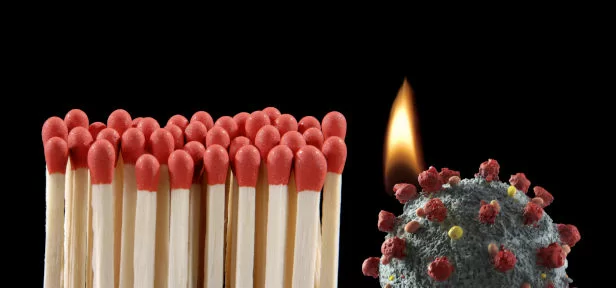

The world will never be the same after the coronavirus crisis. That holds true for Switzerland as well. The crisis will have environmental, political, social and economic consequences. Just how strongly the effects of the crisis will impact our lives is not yet clear.

What is clear is the economy will suffer enormously under coronavirus prevention measures for the remainder of 2020 and most likely over 2021 as well. The recession is hitting some sectors more strongly than others. You can find useful tips on how to react to possible economic changes as an investor here.

Here, moneyland.ch sheds light on developments which are relevant to the Swiss economy and which may be triggered or amplified by the Coronavirus crisis.

1. Accelerated digitization

Digitization has been a megatrend for many years now, but the measures taken to prevent coronavirus have greatly accelerated this trend. This may have a direct impact on many sectors, including banking, insurance and retail, with business increasingly being carried out via the Internet. A strong shift towards the digitization of education across the elementary, secondary and tertiary sectors is also likely.

This megatrend encompasses numerous smaller trends across many industries, and we highlight these in the following points. Regardless of individual industries and sectors, giant international tech corporations are the biggest winners in the trend towards digitization.

2. More e-commerce

Not everyone has suffered from the coronavirus crisis. Online retail has been one of the biggest winners. However, it is important to differentiate between large and small online retailers. Scaling effects have resulted in large online retailers profiting from coronavirus in a disproportionately major way. International online retail behemoths like Amazon and Zalando have been among the biggest winners, while Swiss online retailers like Galaxus and Brack have also profited from this trend. It is likely that many smaller retailers will attempt to enter online retail. However, only a small number of small and mid-sized retailers are likely to survive in an online retail space dominated by giant retail corporations.

3. More cashless transactions

Cash remains extremely popular in Switzerland. As part of coronavirus prevention measures, many fresh produce stores have encouraged their customers to use cashless payments which are deemed to be more hygienic. Card issuers have raised the limit for contactless payments without entering a PIN from 40 francs to 80 francs.

It is likely that the behavior surrounding coronavirus – particularly the heightened hygienic concerns – will make cashless payments more popular in Switzerland too. This trend is a huge boon to the cashless payment services industry – an industry led by giant US corporations Visa and Mastercard. You can find a list of the advantages and disadvantages of cash in this guide.

4. Bank branch office closures

Many Swiss banks closed branch offices during the height of the coronavirus crisis. Customers who previously banked at branch offices were forced to adopt online banking during bank closures, and many of these are likely going to continue using online banking after the crisis. Video calls and apps now allow banks to provide consultation remotely. Account opening will increasingly be done completely online, as is already the case with various neobanks. With banks having a strong interest in reducing employees and cutting costs, we will likely see an acceleration in the trend towards fully digital banking.

5. More home offices and digital meetings

The corona crisis may be the catalyst that tilts employment towards the home office model. Companies stand to save on office rental costs by implementing home office regimes. Many meetings can be efficiently carried out remotely.

But there are reasons why the home office model has not yet widely caught on up until now. Employers are concerned about lower productivity on the part of employees. Employees often prefer working in a conventional work space which offers social contact and face-to-face collaboration to working from home.

Still, many companies in the services industry in particular are likely to increase their use of home office models as a means of cutting costs. Even the use of online conferencing is likely to see an increase.

6. Contactless human-machine interaction

Although there is little evidence to suggest that the coronavirus is transmittable from surfaces to humans, the constant advertisement to wash or disinfect hands and to avoid physical contact will have a lasting psychological impact on consumers. This heightened fear of sickness in general will alter consumer habits long after the coronavirus crisis has passed.

Technologies which enable contactless human-machine interaction are likely to profit from this psychological shift. For example, touchscreens may increasingly be replaced by motion- and voice-recognition technology. But changes in interaction may not only be limited to human-machine interaction. The psychological impact of coronavirus prevention measures may also influence the way people greet or interact with each other on personal and professional levels.

7. More home food deliveries

When compared to its popularity in countries like China and the US, ordering home deliveries from restaurants and take-aways has remained a marginal market in Switzerland. The coronavirus crisis has driven many Swiss consumers to order home deliveries for the first time ever. Many of these consumers will likely continue to order food from home. The coronavirus crisis has driven many restaurants to partner with home delivery services like Eat and Uber Eats. Here too, the main winners of this trend are the big international corporations which operate home food delivery platforms.

8. Less gyms

The forced closure of gyms during the coronavirus crisis has driven many fitness enthusiasts to exercise at home or outdoors. Some practice jogging, while others make use of free workout and training videos. This shift to free exercise models may affect the exercise habits of individuals who previously visited gyms. That shift, combined with the financial losses resulting from closures, will likely result in a major consolidation in the fitness industry.

9. A change in travel habits

Travel service providers have been devastated by coronavirus prevention measures, with the tourism industry being among the worst hit of all industries. It is likely that the regulatory, psychological and financial impact of the crisis will result in a sharp decline in international travel for the remainder of 2020. How long it will take for international tourism to recover is, as yet, unknown.

It is possible that national and regional tourism will grow in the meantime, with tourists opting for local rather than international destinations. Business travel may also decline, with companies which have been able to successfully maintain meetings using teleconferencing cutting down on travel expenses. The reduction in passengers and available flights will likely result airline tickets becoming expensive.

10. Increased local production

The limits and disadvantages of globalization have become clearer than ever during the coronavirus crisis. In Switzerland too, calls for a return to local production and stronger support for Swiss small- and medium-sized businesses have become much louder during the crisis.

Whether or not consumers will be willing to pay higher prices for locally-produced goods than for mass-produced imports remains to be seen.

However, industries which are deemed to be of critical importance to the national good are likely to be reestablished within Switzerland’s – or at least Europe’s – borders. Pressure on companies by consumers to produce locally is likely to increase.

The manufacture of certain medical equipment and medicines is one of the industries which may return to local production. The takeover of strategic Swiss companies by Chinese companies may also be viewed more critically than it has been.

More on this topic:

Coronavirus: Tips for investors

Coronavirus: How secure are Swiss banks?