The finance industry uses a number of longstanding models to calculate risk, products and investment strategies. Prominent models include the modern portfolio theory (MPT) first put forward by economist Harry Markowitz, the arbitrage pricing theory (APT), the capital asset pricing model (CAPM) and the single index model (SIM).

But these prominent models are regularly called into question, especially when major stock market shakeups occur. The global financial crisis of 2008 is one example of an event which caught many investors unawares. But less significant market developments, like the Swiss franc shock on January 15, 2015, have shed light on the limits of longstanding financial models.

One of the most prominent critics of the modern portfolio theory, and its close relative the “standard finance theory”, was the mathematician Benoît Mandelbrot (1924-2010). The founder of fractal geometry was also interested in phenomena occurring in fields other than mathematics, and applied his new instruments to many of these. He spent a great deal of time analyzing financial markets.

The standard model called into question

Mandelbrot did not have an issue with the math behind the standard finance theory (comprised of the modern portfolio theory and its key developments), but he did see flaws in its underlying assumptions. Standard finance theory assumes the best-case scenario with regards to investor and market behavior. Mandelbrot believed that markets are turbulent, insecure and cannot be pressed into the mold of standard finance theory.

These are three of Mandelbrot's most important objections to the accepted theories:

1. Investors are often irrational

Standard models assume that investors act rationally and always look to maximize their own gains. Mandelbrot criticized the fact that this assumption did not account for irrational behavior, and actions which are not driven by profit, even though these things directly influence markets.

2. Prices experience extreme fluctuations

The modern portfolio theory, and theories which build on it (like CAPM), assume that profits from securities are distributed in a normal way. According to this theory, risk follows a Gaussian bell curve, which, in turn, means that extreme price fluctuations should occur very rarely. But the theory does not correlate with reality. In the real world, extreme fluctuations in markets occur much more frequently than a Gaussian distribution allows for. If normal distribution patterns were actually the norm, then a change of more than 7 percent in the Dow Jones index would only happen once every 300,000 years. But in actuality, changes of the size occurred more than 48 times in the twentieth century alone.

3. Price changes are dependent on each other

Standard finance theory assumes a perfect capital market. In a perfect world, all of the information relevant to a share would be figured into its price. Past rate changes would not have any effect on current rate changes. According to Mandelbrot, many financial rate tables have a sort of memory. A period of high price volatility increases the likelihood that further periods of major fluctuations will follow. It should be noted that this pattern applies to volatility, but not to price directions (climbing or sinking rates).

What exactly is a fractal?

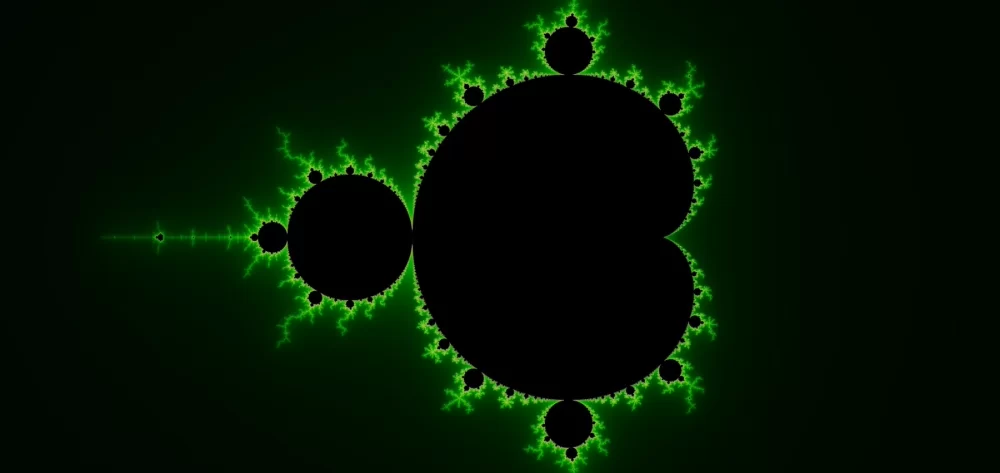

A fractal is a pattern or shape in which each individual part is a reflection of the whole. So, as a rule, the shape of every individual part of a fractal structure is identical to the shape of the structure as a whole, and vice-versa.

Example of a fractal.

Fractal-like structures can also be found in nature. The structures of coastlines and mountain ranges, for example, can often be replicated using fractal geometry. Similarly, stock market rates can be simulated using fractal patterns. Mandelbrot referred to fractals in which the scale varies in different ways across its different parts as multifractals.

Mandelbrot developed computer-assisted multifractal models that could simulate and predict rate changes of various securities. Interestingly, in many cases the pattern is the same regardless of the time frame over which you observe prices.

Practical discoveries

Throughout his analyses, Mandelbrot was not looking to find the exact cause of rate fluctuations. A good analogy can be made based on a motor car: You don’t need to know everything about how an automobile works in order to drive it. Or in the case of stock trading: You don’t need to know exactly why markets behave the way they do in order to successfully understand price changes. For example, you can determine that prices in a given market often fluctuate in a turbulent way without having to know why they do.

These are the five most important practical observations of Mandelbrot’s fractal financial theory:

1. Turbulence is the norm

Financial experts generally recommend that investors diversify their stock market investments, hold onto their stocks over a long period of time and focus on average rates rather than temporary fluctuations. But according to Mandelbrot, this strategy is not completely suited to the turbulent nature of the market, which is heavily influenced by single, major events. Successful investors often make large gains from short-term investments rather than from long-term average returns, because they invest at the right time.

2. Prices jump

People often look for continuity in processes and events, even where it doesn’t exist. Prevailing economic models too are primarily based on the assumption of continuity and smooth market transitions. But these theories don’t match the radical hikes and drops we see in the stock market, and therefore, according to Mandelbrot, are not correct.

Even seemingly insignificant reports or mood swings can result in major changes in market rates. The continuous flood of information circulated via the Internet has greatly heightened these outbreaks.

3. Trading cycles are relative

Popular theories like CAPM are built on the assumption that there is an average investor. They don’t account for the fact that different investors hold onto stocks for different amounts of time. Mandelbrot’s model, on the contrary, distributes trading cycles in a different way than standard models, with time being stretched in some places, and compressed in others. That makes it possible to better account for extreme price hikes and crashes. When you change the investment period, the risk level changes as well.

4. Chart analysis is often irrelevant

Mandelbrot claimed that long term dependencies connect most changes in market rates. This does create a tendency towards rate fluctuations within a specific range, but rates cannot be charted using set, non-fractal patterns at a rate level. For this reason, investors should not place too strong an emphasis on the predictions made by chartists.

5. Volatility is not purely a matter of chance

Mandelbrot believed that volatility and risk can be calculated to some extent, even though actual rates are unpredictable because upcoming rate changes cannot be based on previous stock market climbs. But there is a tendency towards major changes in stock market rates following a sudden rate hike. Volatility predictions can be compared with weather predictions in that they are based on a loose pattern.

Can fractals help you invest more successfully?

Mandelbrot’s discovery of fractals has resonated throughout financial circles. But fractal financial and economic analysis is still a new science. Nobody can say for sure whether or not fractal financial techniques alone will ever be used to create investment portfolios with above-average profits.

But there is nothing to stop you from making use of fractal-based volatility predictions. Traders who invest in market volatility through options or other investment vehicles should theoretically get more accurate predictions using fractal patterns than they would using standard models.

Volatility indexes based on fractal models should be able to predict stock market crashes over the short-term. Much like a weather report, though, the further ahead of the actual event a prediction is made, the less you can rely on the prediction.

More information:

Compare Swiss stock brokers now

Compare Swiss asset management services now

How to choose the right investment fund

Useful tips for investing in stocks