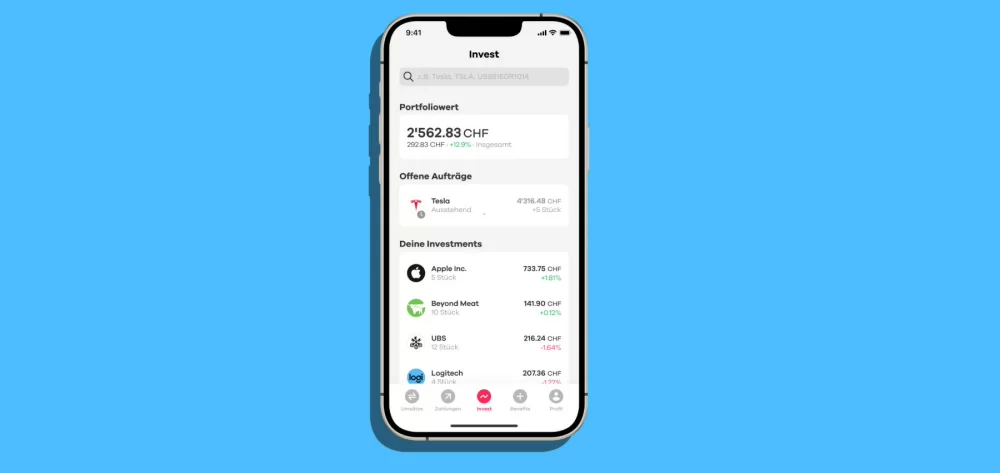

Neon is currently one of the most popular Swiss neobanks, with more than 160,000 customers. It provides customers with a private account and a payment card with favorable currency exchange rates. Now Neon customers can also invest in stocks and exchange-traded funds (ETFs) using the Neon Invest service.

What Neon Invest offers

Neon Invest offers 220 stocks (Swiss and foreign) and 70 ETFs that you can invest in. Its fees are simple: When you buy or sell a Swiss stock or ETF, you pay a fee equal to 0.5 percent of the transacted amount. When you buy or sell a foreign stock, you pay a fee equal to 1 percent of the transacted amount. As with all Swiss banks, you pay the Swiss stamp duty equal to 0.075 percent for Swiss securities, and 0.15 percent for foreign securities. Neon Invest does not charge any custody fees.

Neon offers Neon Invest in collaboration with the Hypothekarbank Lenzburg, the same Swiss bank that hosts Neon’s private accounts. The bank handles the forwarding of stock orders from customers to the stock exchange, and also acts as the custodian bank for your shares. All trades are carried out on the BX Swiss (Bern stock exchange) in Swiss francs. An advantage of Neon Invest is that you are not charged any stock exchange fees.

How Neon Invest compares to Yuh

The Swiss neobank Yuh has offered an investment service for stocks and funds since it was launched. With Neon, an additional Swiss neobank is now offering this service. How does Neon compare to Yuh in this regard?

The selection of securities is similar. Yuh lets you invest in more than 250 stocks, more than 30 ETFs, over 30 themed investment portfolios, and more than 30 cryptocurrencies. The fees charged for Swiss securities are identical, at 0.5 percent. Like Neon, Yuh also does not have custody fees.

But there is a difference in the fees charged for buying and selling foreign stocks and ETFs. Neon charges a brokerage fee of 1 percent, while Yuh charges 0.5 percent – the same fee it charges for Swiss stocks. However, Yuh has an additional foreign currency conversion fee equal to 0.95 percent of the transacted amount.

Another difference is that Yuh has a minimum brokerage fee of 1 franc per transaction. Neon Invest does not have a minimum fee. Yuh gives you the option of buying fractional shares, meaning you can buy just part of a share, while Neon does not.

| |

Neon |

Yuh |

| Selection of investments |

| Number of shares available |

>220 shares |

>250 shares |

| Number of ETFs available |

>70 ETFs |

>30 ETFs |

Number of themed investment

portfolios available |

None |

>30 themed portfolios |

Number of cryptocurrencies

available |

None |

>30 cryptocurrencies |

| Fees for buying and selling stocks |

| Swiss stocks |

0.5% |

0.5%, minimum CHF 1 |

| Foreign stocks |

1% |

0.5% (+0.95%), minimum CHF 1 |

| ETFs |

0.5% |

0.5%, minimum CHF 1 |

| Themed portfolios |

Not available |

0.5%, minimum CHF 1 |

| Cryptocurrencies |

Not available |

1%, minimum CHF 1 |

How Neon Invest compares with online stock brokers

Probably the biggest disadvantage of Neon Invest (and Yuh) compared to online stock brokers is that the selection of securities is relatively small. For the sake of comparison, one large Swiss stock broker advertises the fact that more than 3 million different securities can be traded on its platform. Compared to that offer, the approximately 300 securities offered by Neon and Yuh seem very minimalistic. The fact that trades on Neon Invest can only be performed on the BX Swiss exchange is another possible disadvantage.

An advantage of Neon Invest (and Yuh) is that they have low fees compared to most Swiss banks.

Neon does not charge any custody fees, while most Swiss banks either have custody fees, or charge you an inactivity fee if you do not make a certain number of trades. Even with affordable Swiss online stock brokers, small investors normally have to count on fees of at least 40 francs per year. Often, the costs can be much higher than that. Because Neon Invest does not have custody fees, it is well suited to passive investments in ETFs.

Neon’s brokerage fees – the fees you pay when you buy or sell shares – is also cheap compared to other Swiss service providers. However, some online brokers can be even cheaper than Neon for trades in foreign securities, and for very large trades. The fact that Neon does not charge a minimum brokerage fee per trade is also a positive, especially if you invest small amounts at a time.

The interfaces of neobank apps are normally much simpler to use than professional trading platforms, which is an advantage if you are new to investing. But the very limited functions included in Neon Invest can make it a poor choice for keen traders. For example, Neon only offers market orders, and not limit orders.

Who can benefit from using Neon Invest?

As with Yuh, the main advantage of Neon Invest is that is has low fees. The absence of custody fees is especially beneficial for passive investors.

Buying and selling shares is very affordable – at least for small investors who only invest small amounts at the time. One reason for this is that there is no minimum fee per trade. However, if you invest larger amounts of several thousand francs or more per trade, then some Swiss online stock brokers work out cheaper for trades of that size. Neon Invest is best suited to new or small investors, who are aware of the risks associated with investing in the stock market. For advanced traders, Neon Invest is only marginally suitable due to its small selection of securities and the absence of professional trading functions.

Tip: If you already know which ETFs, stocks, or other securities you want to invest in, check whether they are available in Neon Invest. If they are not, then use an affordable online stock broker instead.

More on this topic:

Detailed information about the Neon account

Compare Swiss stock brokers now