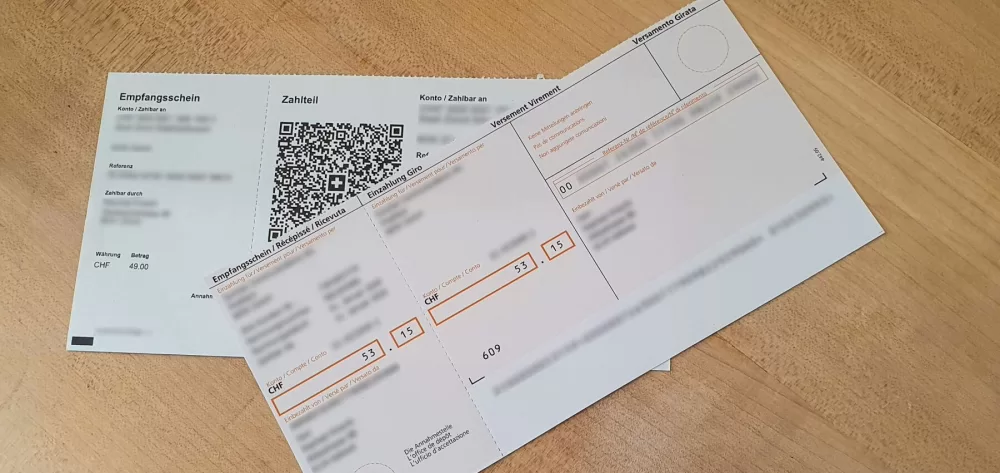

The Swiss deposit slip system is being upgraded. The existing inpayment slip system will be completely phased out at the end of September 2022. From October 1, 2022, only the QR-bill system will be used. As before, you can continue to make bank transfers without using the old deposit slips or QR-bills, if you have the recipient’s IBAN code.

Although there is only one month left until the old deposit slips will become obsolete, the number of payments still being made with these is surprisingly high. In response to an inquiry by moneyland.ch, the Swiss postal bank Postfinance wrote that half of all the standing orders with reference numbers managed by the bank are still based on the old system. As of August 15, 2022, 30 percent of all transfers were still being made using the old deposit slip system. Around 20 percent of all payments at post office counters were made with the old deposit slips as of August 22, 2022.

QR-bill services offered by banks

moneyland.ch also inquired at major Swiss banks about the service provided to customers with regards to using the new QR-bills. All of the banks (Bank Cler, Credit Suisse, Migros Bank, Postfinance, Raiffeisen, UBS, Valiant, and the Zürcher Kantonalbank) offer their customers the option of scanning QR codes using mobile banking apps. Credit Suisse, Postfinance, and UBS told moneyland.ch that they also give their customers the option of scanning QR-bills in desktop online banking using webcams.

However, there are few options for customers who do not want to use mobile banking. Raiffeisen is the only bank included in the inquiry which offers its customers a separate app for scanning QR-bills without mobile banking. Valiant’s solution makes use of a mobile banking app, but lets you scan QR-bills even when mobile banking is deactivated. “The options provided by Raiffeisen and Valiant are ideal for customers who have concerns about the security risks of mobile banking,” says moneyland.ch payments expert Ralf Beyeler.

Only a few banks let you scan bills which you receive electronically (in PDF format, for example). Only Credit Suisse, Postfinance, and Valiant say that PDFs can be read on phones or computers. Customers of the Zürcher Kantonalbank can upload PDF invoices using a smartphone. Migros Bank lets customers transfer PDF invoices with QR-bills to computers.

Theoretically, customers can also buy a separate QR-bill reader. “But that generally does not make financial sense for private customers, as these devices normally sell for over 200 francs,” explains Beyeler.

If you want to have your own QR-bills which other people can use to deposit money into your bank account, you can generally create these using the QR-bill generator on your bank’s website. The online banking services of Bank Cler, Migros Bank, Postfinance, and Valiant also give customers the option of downloading deposit slips which are automatically-generated using their bank account information.

Things to pay attention to as the old deposit slips are phased out

The phasing out of deposit slips primarily affects you if you create deposit slips yourself (to bill customers, for example). In this case, you will have to switch to creating QR-bills. But there are also a number of factors which affect consumers who simply use deposit slips for banking and payments. These are explained below.

Review your standing orders

Review each of your standing orders with your bank as soon as possible. This is important regardless of whether you set up your standing orders using online banking, by mail, or at a bank branch office.

If a standing order uses an IBAN (for Swiss bank accounts, this code begins with CH followed by 19 additional characters), then there should not be any issues. Your bank will continue to transfer money on time as per the standing order in the future.

But if a standing order using a postal account, then you have a problem. You can recognize these by the format of postal account numbers, which look something like this: 12-345678-9. These standing orders will be halted come October. In this case, you have to contact the recipient and ask them to send you either their IBAN or a QR-bill, and use this to replace the existing account number.

Bills with old deposit slips

If you receive invoice bills with the old deposit slips, you can still use these to make the required payments until the end of September, 2022. If you receive any red inpayment slips, you can still pay these after October by using the IBAN printed on the deposit slip. As long as this code is shown, you can use it to transfer the money without a QR-bill.

If you want to pay bills at the post office, you can use a QR-bill generator (like the one offered by Raiffeisen). Simply enter the IBAN to generate a QR-bill which you can print and use to pay at the counter. Alternatively, you can tell the post employee that you did not receive a QR-bill, and show them the IBAN from the red inpayment slip. Postfinance has confirmed that consumers can continue to make deposits at post offices without invoices.

If you receive an orange inpayment slip, your only option is to contact the biller and ask them to send you a QR-bill or their IBAN.

Tips for businesses

Just like consumers, businesses should also check each existing standing order at their banks. It is also a good idea to check your accounting software and payroll bookkeeping for possible payments which use the old system and will no longer be executed from October.

Even more important for businesses and other entities which receive payments to make sure that customers will be able to continue paying you come October. Companies which have used orange inpayment slips, in particular, should make the move to QR-bills immediately.

If moving to QR-bills will take time, then it is absolutely crucial that you include your company’s IBAN on invoices. This enables payers to generate a QR-bill themselves. Alternatively, you could use an online QR-bill generator (like the one from Raiffeisen) to create QR-bills which you can send along with invoices.

These steps make it possible for your customers to continue paying their bills. But they also require more bookkeeping work because bills cannot be generated and sent automatically.

More on this topic:

Compare Swiss private accounts

Swiss QR-bill questions and answers