The negative interest rates imposed by the SNB have left many Swiss wondering what will happen to their savings investments. Is it actually possible that you might soon have to pay a bank to borrow your money from you, rather than the bank paying you for the privilege?

For marketing reasons, it is highly unlikely that banks will impose negative interest rates on private savings accounts. More likely, yield rates on savings accounts, checking accounts and medium term notes will continue to drop, and checking account fees will continue to rise.

Savings accounts at a fee?

In Switzerland, savings accounts are typically free of charge. But exceptions to this rule have been around for some time. For example, the Berner Kantonalbank savings accounts come with a 4-franc annual fee. Fees like this may become more common in the future.

Checking accounts are not free of charge

A checking or current account (sometimes called a “private account” in Switzerland) is not a savings investment instrument. Instead, it is designed to facilitate financial transactions, such as those made with a debit card (such as a Maestro or V-Pay card). Many banks already offer little or no yields on deposits held in checking accounts.

Additionally, many Swiss banks charge account fees which may include general account maintenance fees, and various fees for transfers and cash withdrawals at out-of-network ATMs.

Example of fees and charges

This example based on a fairly average accountholder makes fees and charges easier to understand:

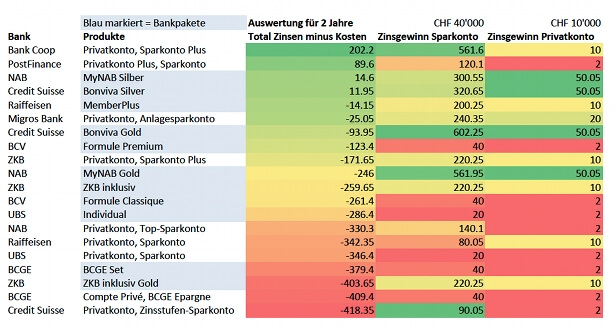

An adult bank customer with very average transaction behavior has 40,000 francs of deposits in a savings account and 10,000 francs of deposits in a checking account.

Comparison over a 2-year term without using a credit card:

The above comparison of 10 important Swiss banks shows that Swiss accountholders already pay a lot of fees. Bank packages are also included in the comparison, because at some banks, these offer more favorable terms than a combination of individual banking services.

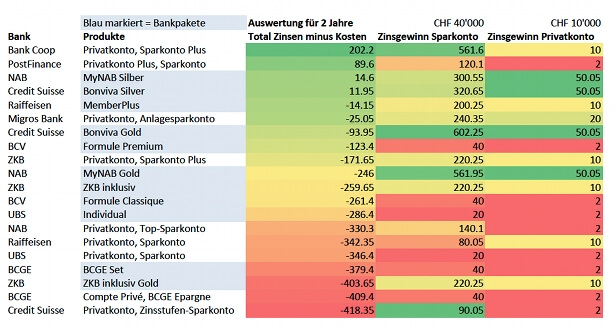

However, the comparison does not present the complete picture because bank packages typically also include an annual fee for at least on credit card. Taking average credit card use into account, the comparison would look like this:

Comparison over a 2-year term with a credit card:

On average, PostFinance and Credit Suisse Bonviva Silver perform the best.

But here too, the fees you pay will depend on how you use your accounts and the amount of deposits you hold in them. Running a bank comparison customized to your specific needs using the interactive comparison tool on moneyland.ch is highly recommended.

More on this topic:

Negative interest rates in Switzerland

Unbiased bank account comparison

Comprehensive savings account comparison