Health insurance premiums often dominate autumn discussions in Switzerland. But one topic that does not receive much attention is how Swiss health insurance companies settle the payment of bills from doctors and other healthcare providers. This guide from moneyland.ch answers the most important questions about how medical bills are paid and reimbursed by Swiss health insurance.

Which medical bills does Swiss mandatory health insurance cover?

Mandatory health insurance covers the cost of doctors, medicines, hospital stays, and other medical care. But the health insurance only covers the part of costs that exceeds your annual health insurance deductible. Additionally, you also have to pay 10 percent of the costs above your deductible as coinsurance, but only up to a maximum of 700 francs for all coinsurance payments combined (350 francs per year for children).

Are different medical bills paid in different ways?

Health insurance claims for medical bills may be settled in different ways, depending on the healthcare provider (doctor, hospital, or pharmacy) and in some cases also the health insurance company. There are no differences in the actual insurance coverage, but only in the way that your medical bills are paid.

Three different systems are used to pay medical bills that are covered by Swiss health insurance:

- Tiers garant (indirect settlement): The doctor or other healthcare provider sends the medical bills to you. You then have to file claims and get reimbursed by your Swiss health insurance provider.

- Tiers payant (direct settlement): The doctor or other healthcare provider sends the medical bills directly to your health insurance company. The health insurance company then settles the payment, and bills you for the portion of costs that you have to cover yourself.

- Tiers soldant (hybrid settlement): The doctor or other healthcare provider bills you for the portion of costs that is not covered by your insurance (deductible and coinsurance), and bills your health insurance provider for the rest.

Do all health insurance companies handle medical bills in the same way?

Some health insurance companies use indirect settlement (the tiers garant system) more than others. That makes a difference for you as a customer, because the more that indirect settlement is used, the more often you will have to pay bills yourself and then file insurance claims for reimbursement. More indirect settlement also means more administrative work for you.

However, there are people who prefer the tiers garant system because managing their medical bills themselves gives them more control over costs. It can also be advantageous if you have your mandatory insurance and supplementary health insurance at different health insurance companies, as can send the bill to the appropriate insurer.

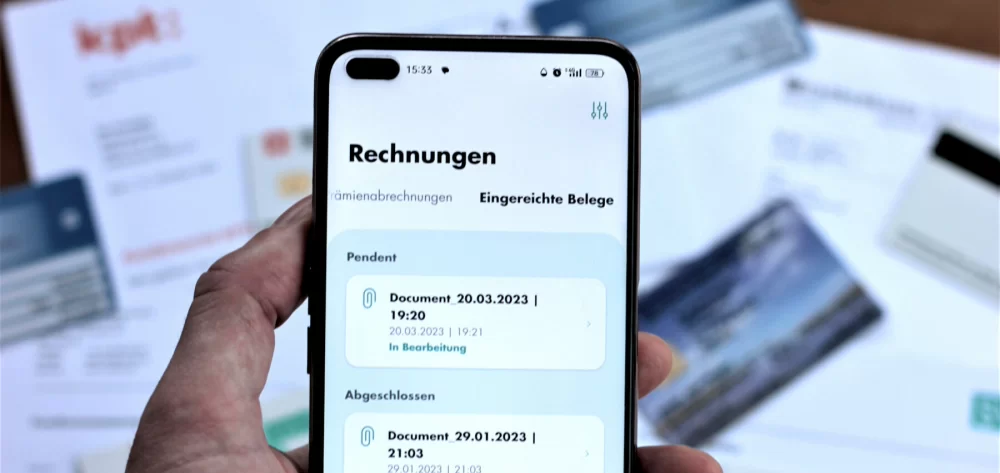

Increasingly, more and more medical bills are automatically charged directly to the health insurance company using direct settlement (the tiers payant system). It is likely that most medical bills will be settled this way in the future.

In autumn, 2023, moneyland.ch asked Swiss mandatory health insurance providers which portions of medical bills they pay using each of the settlement systems. The results are shown in the table below. They are also included on the information pages of individual offers in the mandatory health insurance comparison on moneyland.ch.

Direct and indirect settlement of claims by Swiss mandatory health insurance providers:

| Health insurance provider |

Portion of bills paid

using direct settlement

(tiers payant) |

Portion of bills paid

using indirect settlement

(tiers garant) |

Portion of bills paid

using a hybrid of direct

and indirect settlement

(tiers soldant): |

| Assura |

36% |

64% |

0% |

| Atupri |

80% |

20% |

0% |

| Concordia |

90.50% |

9.50% |

0% |

| CSS |

90% |

10% |

0% |

| EGK |

87% |

13% |

0% |

| Helsana |

82% |

18% |

0% |

| Klug |

91% |

9% |

0% |

| KPT |

80% |

20% |

0% |

| Groupe Mutuel |

90.90% |

8.70% |

0.40% |

| ÖKK |

90% |

10% |

0% |

| Swica |

88.30% |

11.60% |

0% |

| Sympany |

81% |

19% |

0% |

| Visana |

80% |

20% |

0% |

Are the waiting periods for reimbursement the same at all health insurance companies?

The amount of time you have to wait until you are reimbursed for medical bills that you pay up front (tiers garant system) varies from case to case, and from one health insurance company to another. In autumn, 2023, moneyland.ch asked health insurance companies what their average waiting periods for reimbursements are. You can find the average amount of time it takes for benefits to be paid out once a claim is made in the table below. Waiting periods are also shown on the information pages of individual products in the moneyland.ch Swiss mandatory health insurance comparison.

Waiting periods for indirect claim settlements at Swiss health insurance providers:

| Health insurance provider |

Average waiting period for reimbursements |

| Assura |

9-14 days |

| Atupri |

3 days |

| Concordia |

8.25 days |

| CSS |

7.7 days |

| EGK |

5 days |

| Helsana |

9 days |

| Klug |

4 days |

| KPT |

3-5 days

(Manually processed claims: 10 days)

|

| Groupe Mutuel |

10.8 days |

| ÖKK |

3.5 days |

| Sodalis |

10-14 days |

| Swica |

2.3 days

(up to CHF 1000: 2.1 days)

(from CHF 1000: 7.3 days)

|

| Sympany |

7 days |

| Visana |

8 days |

What can I do if I cannot pay my medical bills up front myself?

If a medical bill is charged to you (tiers garant system) and you cannot or prefer not to pay it yourself, you can ask the doctor for a new bill that has a longer payment deadline (an additional 30 days, for example). You should then send the bill to your health insurance provider as quickly as possible. This adds extra time for the health insurance company to pay out the money that you need to cover the bill.

A less common alternative: According to the Federal Office of Public Health (FOPH), you can ask your health insurance company to use the tiers soldant system. In this case, you transfer your right to claim to reimbursement from the insurance company to the doctor or other healthcare provider.

How are hospital bills paid by Swiss health insurance?

There are clear laws governing how medical bills for inpatient treatment in hospitals must be settled. Direct settlement (the tiers payant system) must be used. The hospital bills your health insurance provider directly. Your health insurance company then bills you for any uncovered costs such as your deductible and coinsurance.

If treatment at a hospital lasts less than 24 hours, than it is considered to be an outpatient treatment. Medical bills for outpatient treatments can be billed using either the tiers payant or the tiers garant system.

How are purchases from pharmacies paid by Swiss health insurance?

Purchases of covered medicines at pharmacies are normally charged directly to your insurance company using the tiers payant system. In this case, the pharmacy records the transaction and send the bill to your health insurance provider. Your health insurance company then sends you a bill for possible deductible and coinsurance costs.

Some pharmacies offer a discount if you pay for medicines directly yourself. If you want to take advantage of these discounts, you can pay for your medicines immediately at the pharmacy, and then claim reimbursement from your health insurance provider.

There are some health insurance companies that use indirect settlement (the tiers garant system) for purchases of medicines.

How are doctor’s bills paid by Swiss health insurance?

Medical bills for outpatient treatments by doctors are settled using either the tiers payant or the tiers garant system. Which system is used depends on possible agreements between your health insurance provider and the specific doctor, or their healthcare network or medical association.

So the way your bills are paid depends on the specific health insurance company and healthcare services you use. Which canton you live in can also affect how bills are paid.

Some mandatory health insurance providers let doctors choose which billing system they prefer. Some medical practices inform patients about which billing system they use.

Which billing method is used for Swiss supplementary health insurance?

The same health insurance company may use different claims settlement systems for their mandatory health insurance and supplemental health insurance. Indirect settlement (the tiers garant system) is used much more often for supplemental health insurance than for mandatory health insurance.

If, for example, you want to claim supplemental health insurance benefits for glasses or contact lenses, you will have to submit a copy of the optician’s bill or receipt to the health insurance company to claim reimbursement.

Depending on the health insurance company and the kind of benefit you are claiming, it can take many weeks, in some cases, before you get reimbursed. For that reason, it can be beneficial to keep an emergency fund so that you have money to pay if medical bills become due before you receive the insurance benefits.

More on this topic:

Find the best Swiss mandatory health insurance now

Swiss health insurance: Covered costs

Health insurance deductibles: Getting it right

Swiss health insurance: Managed care models explained