1. What is Wise?

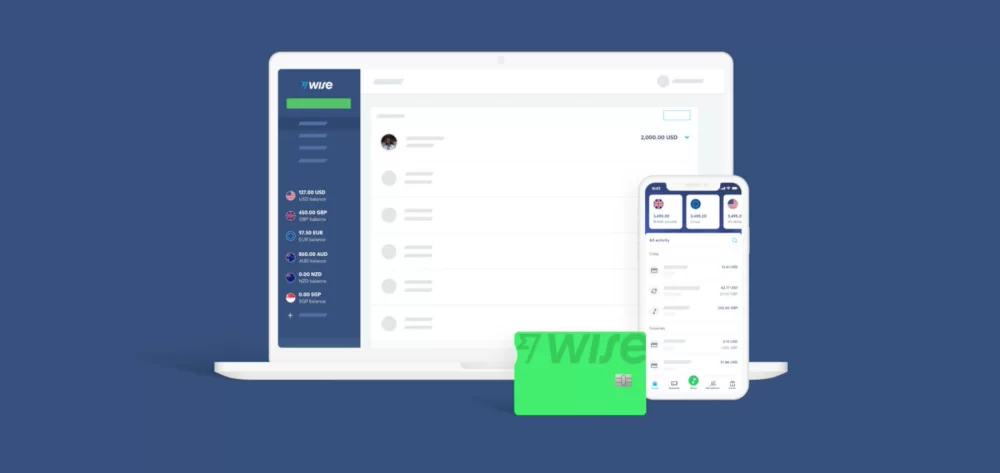

Wise (formerly Transferwise) is a neobank headquartered in the United Kingdom. It offers a multi-currency account and a Visa Debit card (it previously used the Debit Mastercard). Wise has very favorable currency exchange rates, and specializes in low-cost international transfers.

2. Which services does Wise offer?

The primary service offered by Wise is low-cost international transfers.

Another important service is the Visa Debit card. This card can be used to pay for purchases from both brick-and-mortar and online merchants, and to withdraw cash at ATMs.

You can manage the debit card using the Wise app or web portal. The app lets you choose from many different settings. It also notifies you of card transactions in real time.

The multi-currency account is another key feature. The Wise multi-currency account lets you open multiple sub-accounts in different currencies. More than 50 different currencies are offered. This lets you hold and manage many different currencies using just one service. You can exchange and transfer money between your currency sub-accounts at any time. You can download statements for each sub-account individually.

More than 50 currencies can be held on the multi-currency account. Wise can also be used for business customers and synchronized with accounting tools.

3. Are Wise account balances covered by Swiss depositor protection?

Currently, Wise is not a fully-licensed bank. It has E-Money licenses in the UK and Belgium.

Money which you deposit into Wise accounts is not covered by Swiss bank depositor protection. If Wise were to go bankrupt, you would have to apply for compensation in the United Kingdom or in Belgium.

4. Is Wise a Swiss bank?

No. Wise is not a Swiss bank and only has E-Money licenses in the United Kingdom and Belgium. Wise is authorized to accept money from its customers and to manage money on customers’ behalf. However, Wise must hold all customer money in third-party banks, and is not authorized to offer loans.

5. How can I deposit money into my Wise account?

The cheapest and easiest way to load your Wise account is by making a transfer from your Swiss bank account to Wise’s Swiss bank account in Swiss francs. This is generally free of charge. The transfer must be made from an account in your name. You get a reference code which you must specify when making transfers.

You can also load your Wise account using your credit card, but loading your account this way can generate high fees.

6. Which cards does Wise offer?

Wise offers a Visa Debit card which is linked to your multi-currency account. You can use the card to pay at Swiss and foreign merchants which accept Visa Debit. You can also use it to withdraw cash from your multi-currency account at ATMs.

When you pay for a purchase using the Wise card, the sub-account denominated by the relevant currency is used by default. If you make a purchase in a currency for which no sub-account balance is available, another currency you hold is automatically exchanged to cover the card transaction.

Wise offers customers up to three virtual cards.

7. Does Wise offer a Maestro card?

No. Wise does not offer a Maestro debit card.

8. Can I make bank transfers with Wise?

You can use Wise to transfer money to bank accounts in Switzerland and abroad.

Transfers within Switzerland cost 50 centimes. That makes Wise a poor choice for local transfers, because Swiss banks generally do not charge fees for transfers within Switzerland in Swiss francs.

But Wise is a sensible option for international transfers. For bank transfers to exotic countries in particular, Wise is often much cheaper than banks. Wise uses very favorable currency exchange rates on par with interbank rates.

Because Wise uses a peer-to-peer system which bypasses international clearing banks, it does not have the hidden fee problem which plagues many conventional banks.

Another advantage of the Wise system is that transfers to many countries are completed very quickly. With around half of all transfers made with Wise, the money arrives in recipients’ accounts in less than an hour.

9. Which currency exchange rates does Wise use?

Wise uses the currency exchange rates published by Bloomberg. Studies by moneyland.ch have shown that Wise uses very favorable exchange rates.

10. Does Wise charge foreign transaction fees?

Wise charges foreign transaction fees for currency exchanges. The fees are clearly shown in the app or web portal. Foreign transaction fees vary between currencies. When Swiss francs are exchanged to widely-used currencies like euros, US dollars or British pounds, you pay a foreign transaction fee of less than 0.50 percent. For exchanges into less-widely-used currencies, the foreign transaction fee is typically under 1 percent.

11. Can I make cash withdrawals?

Yes. You can withdraw money from your Wise account at ATMs using the linked Visa Debit card. You can withdraw the equivalent of 200 francs per month at ATMs in Switzerland or abroad without paying cash withdrawal fees. A 1.75 percent cash withdrawal fee applies to the portion of monthly withdrawals exceeding the 200-franc limit. An additional fee of 0.50 francs per withdrawal will be charged from the third ATM withdrawal per month.

12. Can I use Wise for mobile payments?

Yes. You can link the Wise card to Apple Pay and Google Pay. You cannot currently use Wise with the Swiss Twint mobile payment service.

13. Can I transfer money directly to other Wise users?

Yes. You can transfer money directly to other Wise users using the app or web portal. Transfers between users are fast and free of charge.

14. Are there limits on transactions?

As a general rule, you can use the card to pay as long as you have money in your Wise account.

Wise does have limits on total transactions, but these only affect you if you make transact in relatively large amounts. The limit for card transactions (including via mobile payments) is 30,000 British pounds (approximately 35,000 Swiss francs) per month. You can specify lower limits for card transactions in the app or web portal.

15. Can I set up standing orders?

Yes. Wise gives you the option of setting up standing orders for recurring transactions.

16. Can I receive eBills or set up direct debit orders?

No. Swiss direct debit orders and eBills are not currently supported by Wise.

However, you can set up SEPA direct debit orders for transactions in euros. You can also set up UK direct debit orders and Australian direct debit orders.

17. Does Wise offer savings account or pillar 3a retirement accounts?

No. Wise does not offer any Swiss bank accounts, savings accounts or pillar 3a accounts.

Wise does let you open segregated sub-accounts for savings called jars. These are not linked to your debit card, so their balances cannot be spent unless you first transfer the money to a regular sub-account. Note that like other Wise sub-accounts, jars are not actual savings accounts.

18. Do I get my own unique bank account number with Wise?

Wise does not give you your own Swiss bank account number. Deposits in Switzerland must be made into Wise’ collective Swiss bank account and defined using your unique deposit reference code.

However, the euro sub-account in Wise is a genuine euro-denominated Belgian bank account with a unique IBAN. The sub-accounts denominated by British pounds, US dollars and Australian dollars also have unique bank account numbers.

19. Can I overdraw my Wise account?

No. Wise does not offer an overdraft facility and works on a strict prepaid basis. You cannot overdraw your multi-currency account.

20. What are the advantages of using Wise?

The biggest advantages of using Wise are the competitive currency exchange rates, the low fees and the fast international transfers. Wise is an affordable option for international transfers to many countries and for card-based purchases or cash withdrawals in many countries. The intuitive app and practical web portal are additional advantages.

The notifications which you receive whenever transactions are made are also useful.

The option of getting unique bank account numbers in Belgium, the UK, the US and some other countries is also interesting. These let you receive payments in those countries without any transfer costs. You also avoid having to exchange currencies when receiving payments.

21. What are the disadvantages of Wise?

Money held in your Wise multi-currency account is not secured by Swiss bank depositor protection.

A significant disadvantage for Swiss consumers is that Wise does not currently give you a unique Swiss account number and you cannot currently receive payments from third parties in Swiss francs. This makes it unsuitable for receiving payments in Swiss francs (a Swiss salary, for example) or for making payments to recipients who require a unique bank account in your name. You will need an additional Swiss bank account for these purposes.

More on this topic:

Compare Swiss private accounts now

Compare Swiss credit cards now